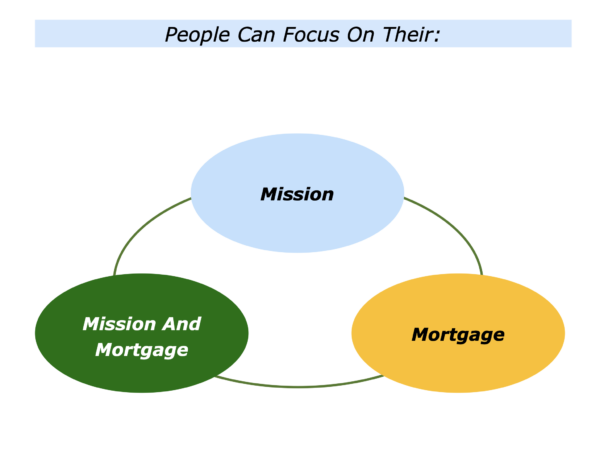

What gets you out of bed in the morning? Your mission, your mortgage or a combination of both? A person may aim to get the right blend in their life. They may say something like:

“I’d like to pursue my labour of love, but also maintain a certain lifestyle. Is that possible?”

Let’s explore how you can balance pursuing your mission and paying your mortgage.

Pursuing Your Mission

Many people who feel fulfilled in their work have a similar pattern. Early on in their professional lives – between the ages of 16 and 28 – they followed their passion.

Years later they may have learned how to make money, but during that formative time they pursued their mission. This may have been hazy, such as wanting:

“To help people … To create beauty … To fight for justice … To show a better way … To make inspiring music.”

They did everything possible, however, to explore and then pursue their chosen road. Later they translated this mission into ways they could pay their mortgage. Bearing this in mind, somebody may ask:

“Sound okay, but what about after 28, is there hope?”

Of course, but this calls for regaining the habit of doing what you enjoy. Why? People make financial commitments from their mid-20s onwards.

They may want to regain their sense of purpose, but are not sure how to do so whilst, at the same time, paying their mortgage.

People who make this transition successfully often take the following steps.

They clarify their mission – their purpose – by identifying their long-term picture of success;

They clarify the principles they can follow to pursue these goals;

They translate the principles into daily practice and work towards their picture of success.

They do something each day – however small – that contributes to achieving their life goals. Such habits become a lifestyle and begin to fulfil their sense of mission.

The Guaranteed Income Approach

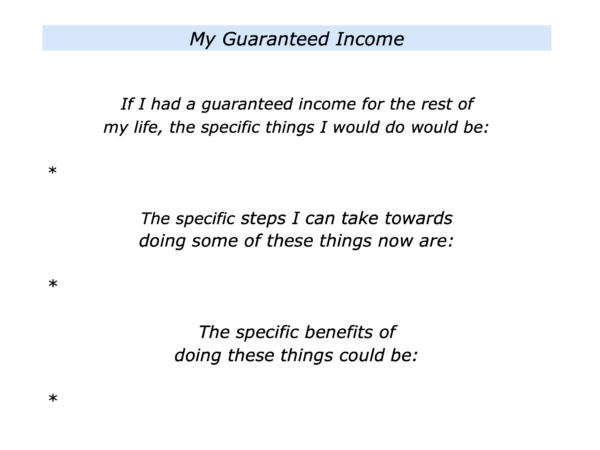

There are many exercises that people use to clarify their mission. One approach is to invite a person to do the old exercise My Guaranteed Income.

As you may know, this invites a person to explore the following theme.

“Imagine that you had a guaranteed income for the rest of your life. You had enough money live comfortably. What would you do?”

Few people say they would do nothing. Many reflect for a while. Then they say:

“What I would really like to do would be …”

They often describe things that would make their soul sing. Bearing in mind their answers, one approach is to explore how they can begin doing some of these things.

Sometimes later they can focus on how they can do fulfilling work and, if they wish, get some funding. At the very least, however, this exercise provides a good beginning for getting the creative juices flowing.

If you wish, try tackling the exercise on this theme. This invites you to complete the following sentences.

Paying Your Mortgage

Many people want to maintain a certain lifestyle. The often means earning enough money to pay the mortgage. Sometimes this works out well. Sometimes it can lead to over-stretching, which can lead to problems.

Sometimes unexpected events cause people to assess their life goals. One person explained this in the following way.

“Five years ago our family went through a crisis. My partner became ill and I almost lost my job. Like many people in this situation, we asked:

‘How much money do we need – as opposed to how much do we want?’

“Eventually we found it was possible to live on just over half our previous outgoings.

“Getting back in shape meant, for example, buying and using food carefully, rather than throwing lots of it away; reducing outgoings, such as certain kinds of insurance; and selling-off stuff at car boot sales.

“Looking back, the crisis taught us to value what was really important. We had spent years spending money on things that weren’t necessary.”

Financial turnarounds take time and creativity. But it can be liberating to feel that you – rather than others – are shaping your financial future.

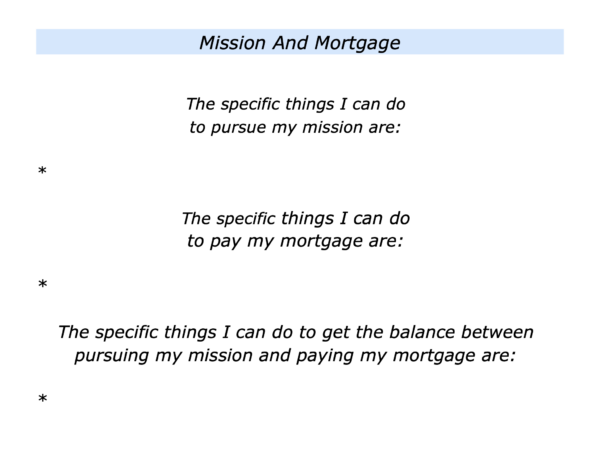

Pursuing Your Mission

And Paying Your Mortgage

How to get the right balance? If you are already following your mission, then it may be a case of aiming:

To do more of the things you find fulfilling;

To get enough funding to pay the mortgage.

By continuing to follow this pattern, eventually every piece of work will contribute to pursuing your mission, as well as paying the bills.

If the gap between mission and mortgage work is too painful, however, then it could mean making a transition.

Let’s consider how to make this happen. We are sometimes told:

“Do what you love and the money will follow.”

This sounds good, but another mantra is:

“Build on your strengths, do superb work and help your customers to succeed.

“Keep doing the right things in the right way every day. Then maybe the money will follow.”

Imagine that you want to take this step. Let’s explore some of the potential options.

One option may be to build on the satisfying parts of your present role. It is then to expand these until they can be translated into a full-time role.

How to increase the chances of an employer being attracted to such a proposal? They are more likely to accept it if they can see how it will help them to be successful.

Bearing this in mind, it will be vital to show how doing this role will benefit the employer. You can then ensure it is provides wins for both yourself and your organisation.

A second option is to move to another employer. When doing this, however, it will be vital:

To clarify how you can build on your strengths, do satisfying work and help the employer to achieve success.

You can then position what you offer: a) by showing the employer you understand their challenges; b) by showing how you want to use your strengths to help them to achieve success.

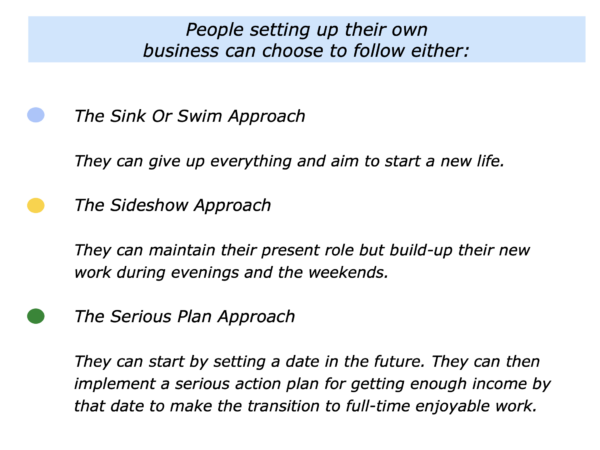

Imagine that you have tried these approaches but prefer to go another route. You may want to go freelance or set up your own business.

There are several routes you can follow to make this happen. Here are three of the most common approaches.

The Sink Or Swim Approach

A person may get to this point because they feel overwhelmed and want to change everything immediately. They may say something like the following.

“I am totally fed-up with my present job. So I will hand-in my notice on Friday, give-up everything and start afresh. I will make it or bust.”

Sounds brave and sometimes it works. Two types of people pursue this route successfully.

Emigrants who leave their country and start again with few assets.

They work hard from day one and are also street-wise.

Entrepreneurs who start their business fired by anger.

They may have got sacked or got frustrated trying to get an idea through the bureaucracy of an organisation. They may say things like:

“I will show them. I will never be beholden to anybody again.”

There is one group for whom this approach is less likely to work. People who are semi-institutionalised, disaffected with their present job and think that if they have a good idea the money will roll-in.

The pluses of the approach are that you start straight away, are forced to use your creativity and feel great if you succeed. The minuses are that you have little security, have few customers and may use all your energy just to survive.

The Sideshow Approach

A person may take a medium-term view. They may say something along the following lines.

“I will keep my full-time job but develop my own business on the side. I want to make sure the side business works before making the transition.

“If the part-time business takes-off, then I will quit my present job. I will then invest the time and money needed to make my business into a profitable enterprise.”

The sideshow approach has become more common over the past decade. Previously frowned-upon by employers, it is now actually encouraged by many new media businesses, providing it does not clash with the corporate goals.

Frequently I hear people who take this route saying things like:

“I enjoy working here, but I also have another business which I work on it in the evenings.

“My partner runs the company, but I provide consultancy.

“I had the initial idea, but I found two people who took it to market and I sit on the board.”

The pluses of this approach are you retain a sense of security. You can build from a position of strength and try many things to see if they work without risking everything.

The minuses are that you may feel split and exhausted. You may never progress beyond being a small business. You may also still take calculated risks when going full-time.

The Serious Plan Approach

A person may take a calculated long-term view. They may say something along the following lines.

“I will stay in my present job for the moment, but aim to become a self-employed consultant in 6 months.

“By that date I aim to have customer orders totalling £25k for the first quarter.

“Starting from this goal and working backwards, I will make a specific plan showing the concrete things I must do to translate the dream into a reality.

“For example, I can probably get some work from my current employer, plus my previous boss who has left to join another company.

“Providing I do something every day towards getting future customers, I will probably achieve my goal by that date.”

The serious plan approach has a good chance of success, providing the person implements it with a sense of urgency. This final point is crucial.

Sometimes in mentoring sessions I invite a would-be freelancer to consider the following scenario:

“Imagine that your present job is going to disappear in 6 months.

“You are then not allowed to work full-time with any company. But you are allowed to do freelance work for people in your present company and for other organisations.

“Who would be the first three people you would contact? What would you offer to these people? How could you help them to be successful? Do you think you would be able to survive?”

People invariably say they would survive, perhaps even thrive. They may only leap into action, however, when the knife is on their throat.

The pluses of this approach are that you build from strengths and minimise the risks. You reach satisfying milestones along the road and create the basis for building a successful business.

The minuses are that you must be disciplined and encourage yourself on the journey. You may experience conflicts of interests, especially with present customers who you may want to keep when you go freelance. You will never feel 100% certain of financial security.

A person may look at their various options and prefer to stay in their present role – even if it unsatisfying. This is also a choice and it has consequences.

The person can recognise that they have made this choice rather than feel resentful. They can then aim to build on the pluses and manage the minuses.

Let’s return to your own life and work. How can you continue to get the right balance between your mission and mortgage? What will be the benefits of taking this approach?

If you wish, however, try tackling the exercise on this theme. This invites you to complete the following sentences.

Leave a Reply